Member Login

Identity Theft & Fraud: How to Protect Yourself

In today's hyper-connected world, safeguarding your online identity is paramount. Join us for an insightful recorded webinar hosted by GreenPath Financial Wellness. They will delve into the essentials of identity theft and online fraud, illuminate common scams to watch out for, and equip you with strategies to fortify your digital defenses.

Common Questions on Debt Management Plans

When it comes to Debt Management Plans (DMPs) there can be a lot of unknowns—how they are set up, what the process looks like on our side, and the ways debt management can impact your overall financial picture. We’re wholehearted believers that educating yourself is the first step towards building healthy money habits, so we’ve rounded up several questions that our counselors hear most often.

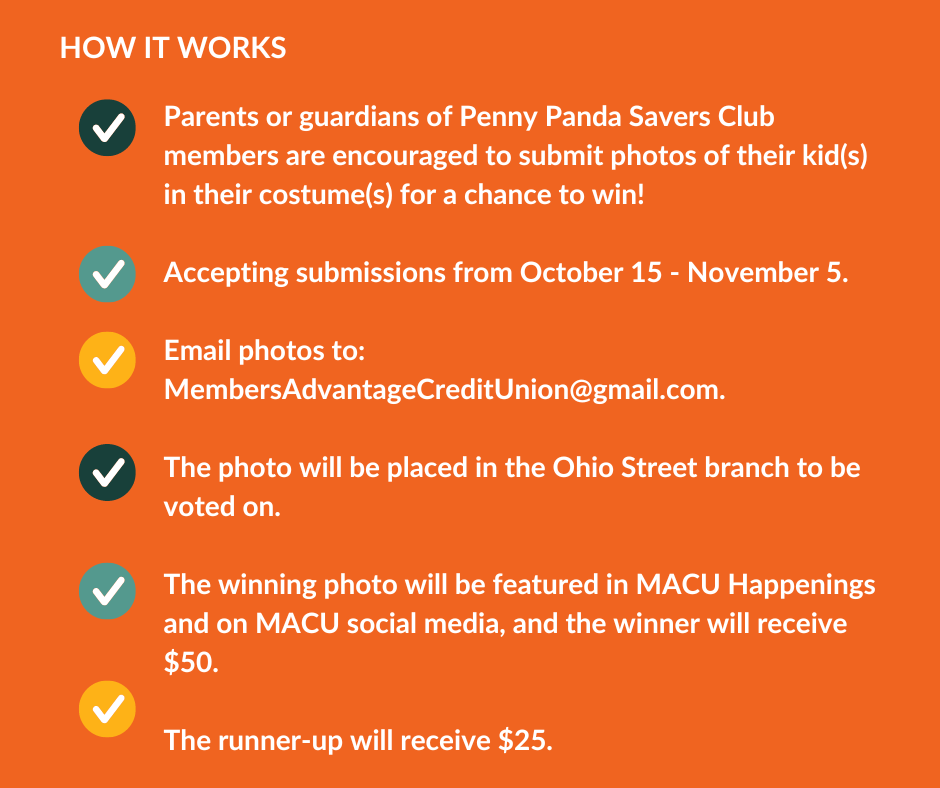

Penny Panda Costume Contest

Calling all Penny Panda members! Get ready for some spooktacular fun this Halloween season. Parents or guardians of Penny Panda Savers Club members, it's your time to shine! Dress up your little ones in their Halloween best, snap a pic, and submit it for our costume contest.

Penny Panda Movie Morning 2024

Calling all Penny Panda Savings Club members! Mark your calendars for this year’s movie morning on Saturday, December 7, 2024.

Switch to Kasasa

Make the switch to financial freedom today! Experience the ease and rewards of our free Kasasa Checking account. Say goodbye to monthly fees and hello to a brighter financial future. Join us now and enjoy banking that works for you.

Call or stop by any branch to learn more!

https://www.macuonline.org/products-services/checking

4 Steps to Take with Your Student Loans

Borrowers should be ready to make student loan payments. Here are steps to move forward as protections end.

Download 4 Steps to Take with Your Student Loans PDF

No need to worry about your deposits! MACU has you covered.

Mortgage Meet & Greet

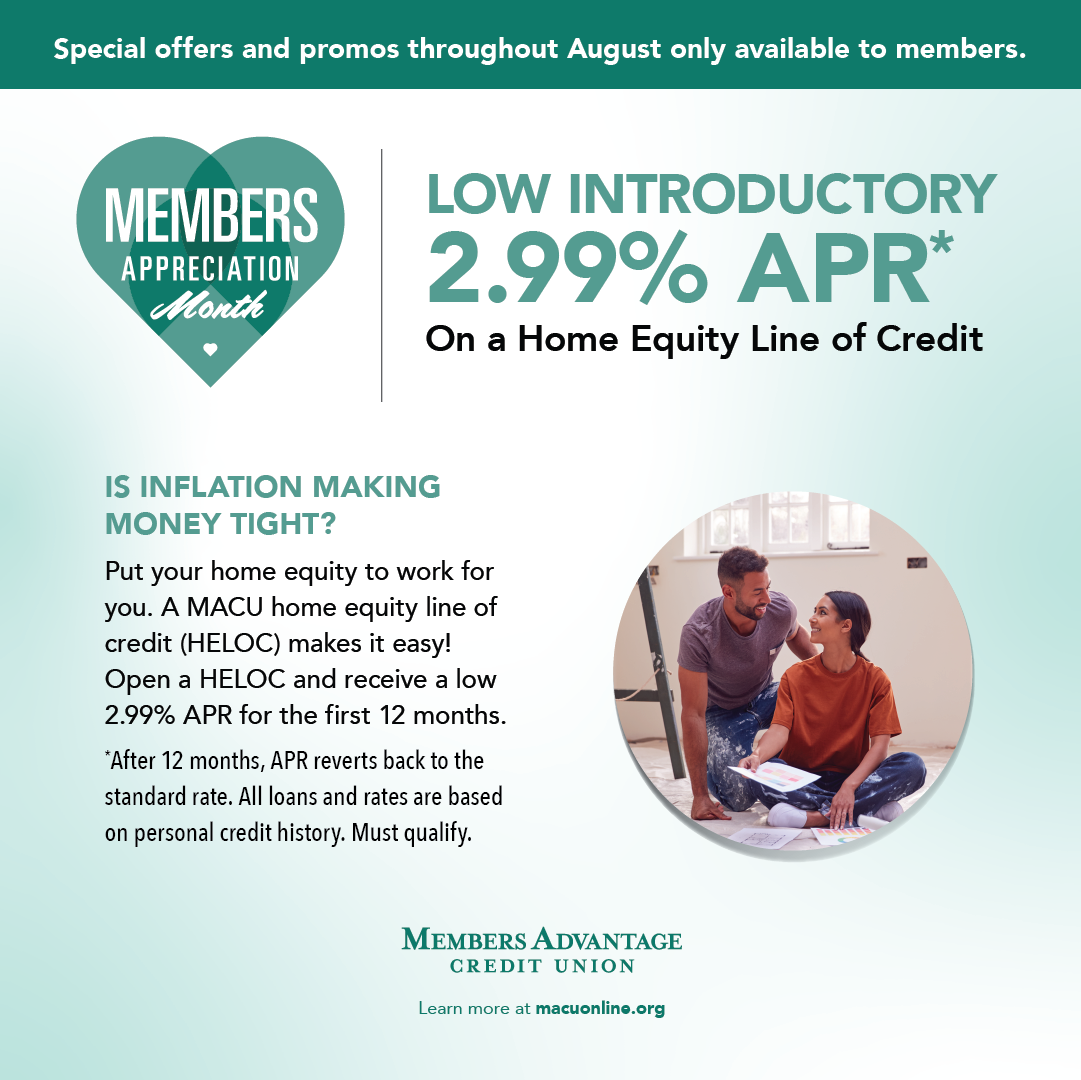

Members Appreciation Month 2022

At MACU, we love our members and are excited to celebrate you. During Members Appreciation and throughout the whole month of August, we have some great deals and giveaways for you. This is our way of saying THANK YOU!

Contest now closed.